The VAT return will report on both Imports and Exports from the European Union and also on Imports and Exports from outside of the European Union.

These are discussed seperately :-

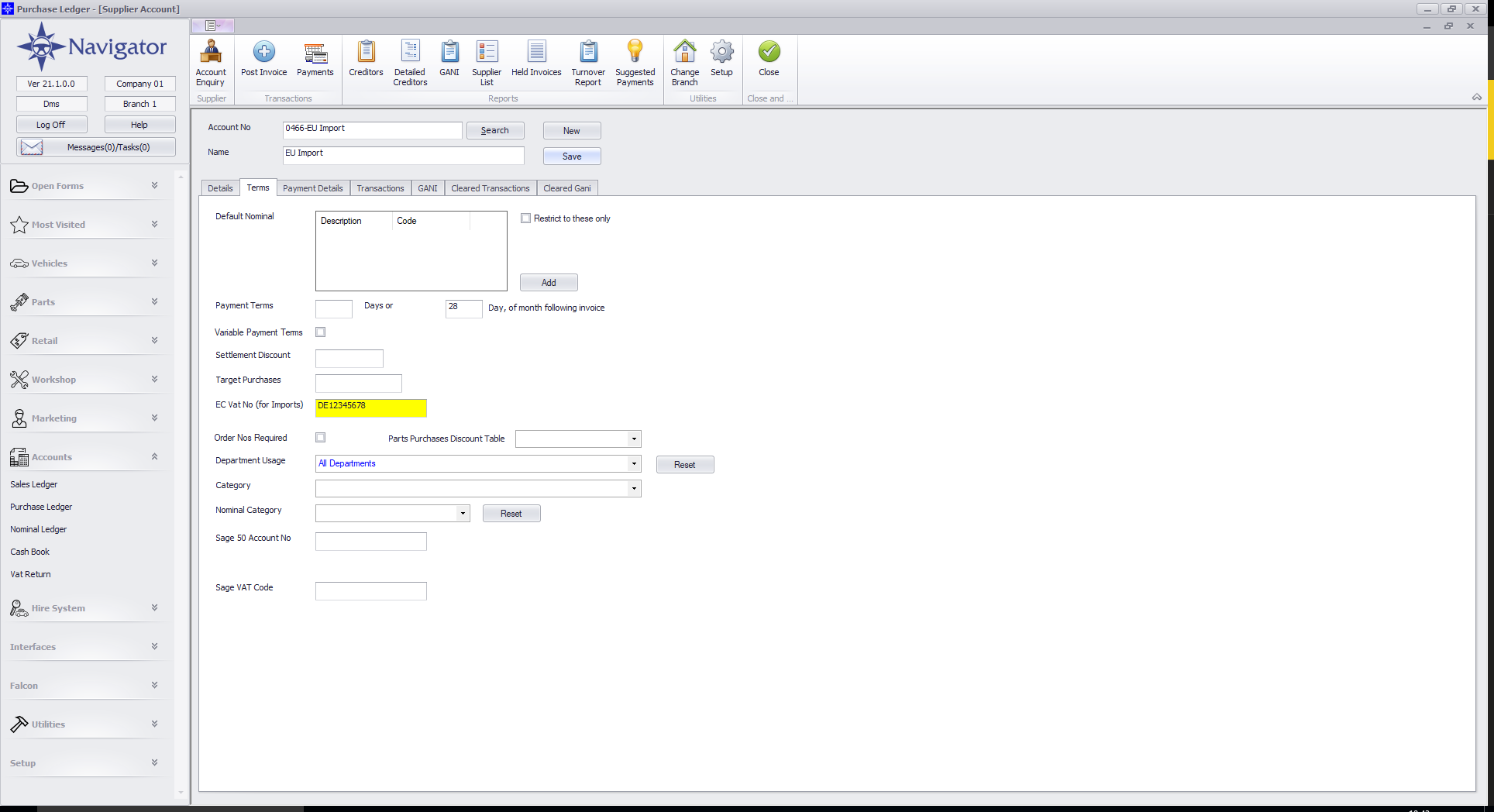

Imports from the EU

On the supplier account, it is necessary to enter the EU VAT number onto the "Terms" tab of the supplier account, as per the screen shot below :-

Note that the VAT number should include the full 2 digit ISO country Code prefix (eg "DE" for Germany in the example above).

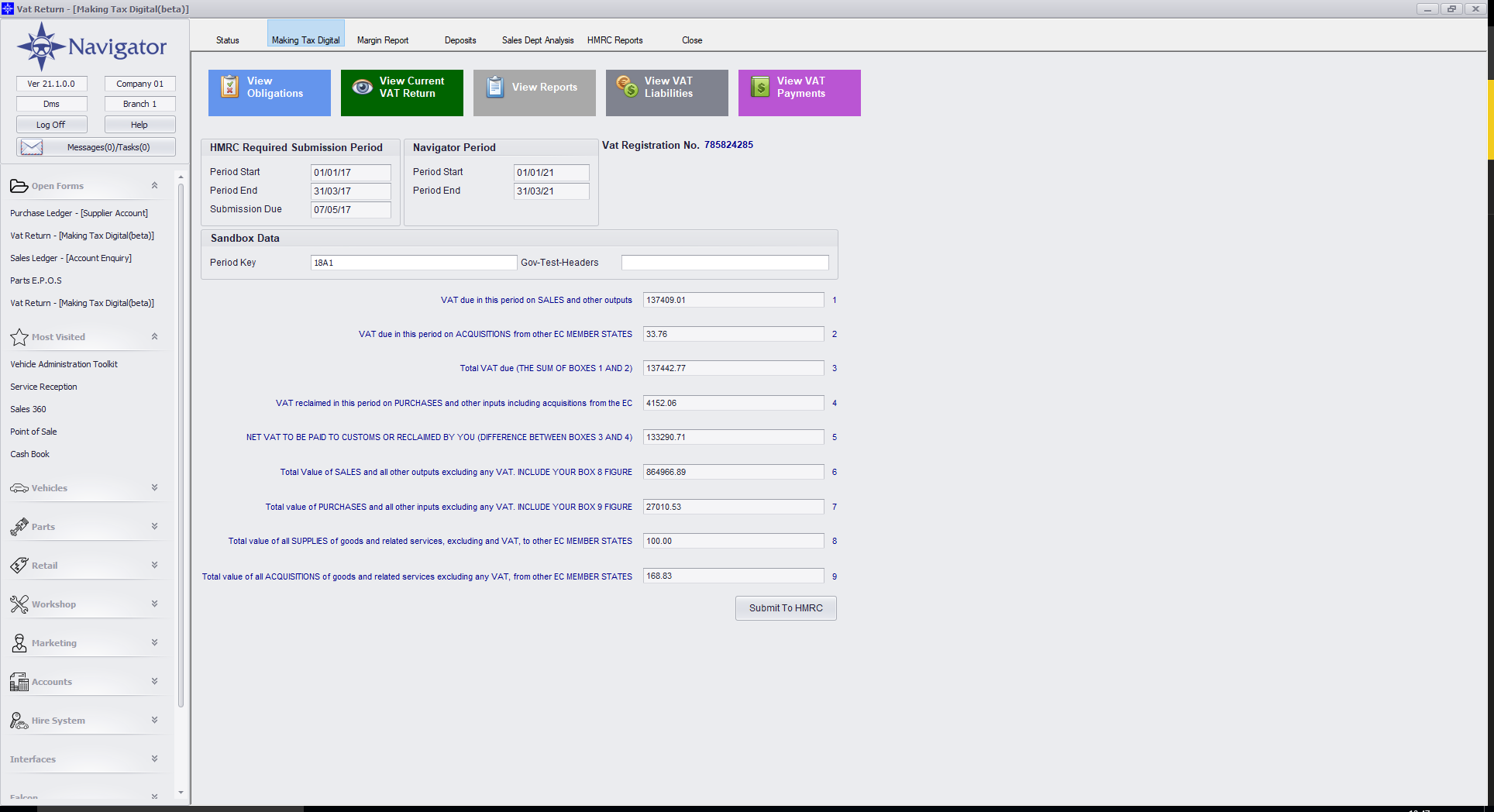

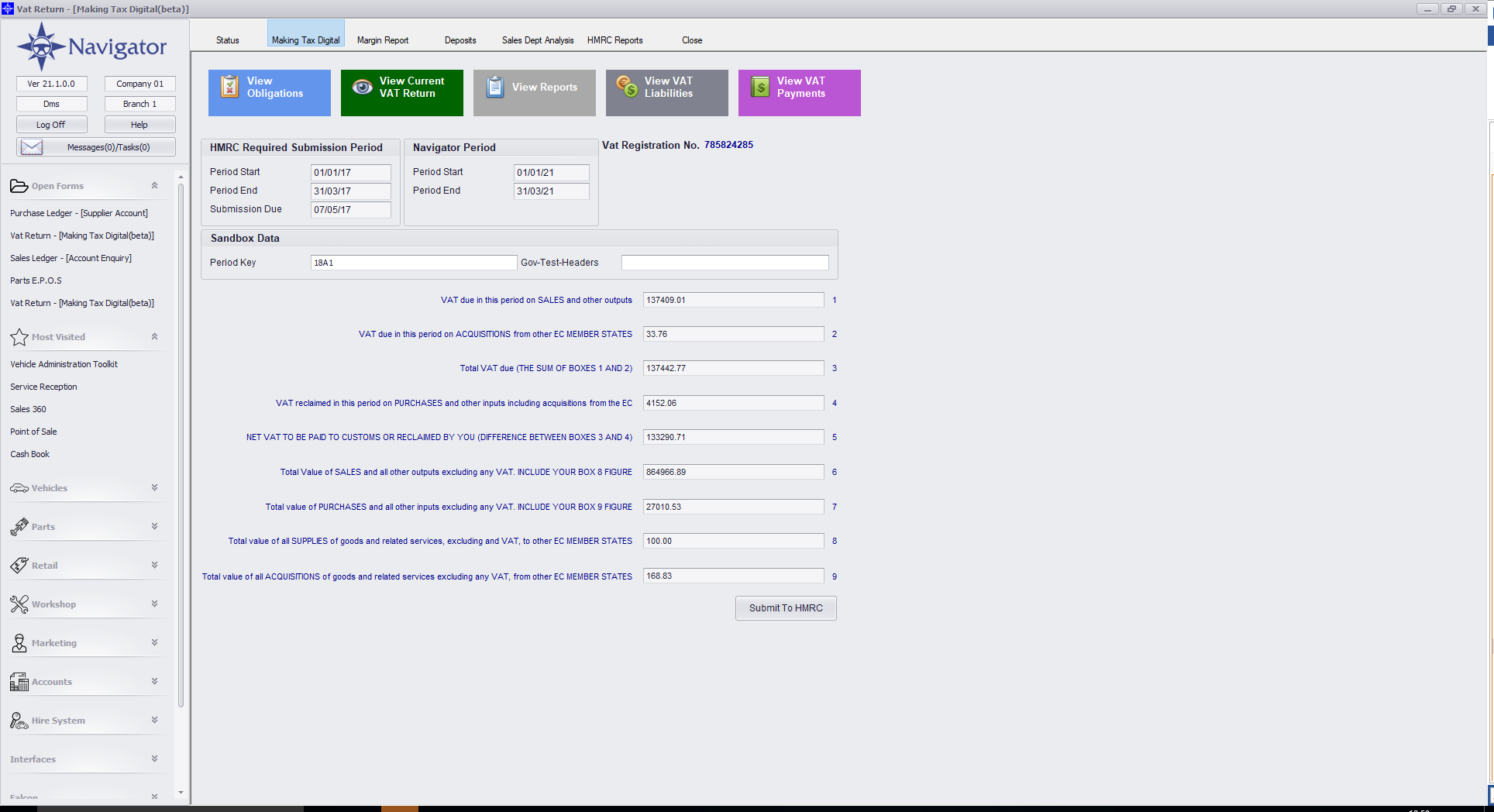

Any purchase invoices posted to this supplier account will be flagged as an EU Import and will be reported on Box 9 of the VAT 100 and the VAT added to box 2 to calculate VAT using the Reverse Charge Mechanism, as per the example below :-

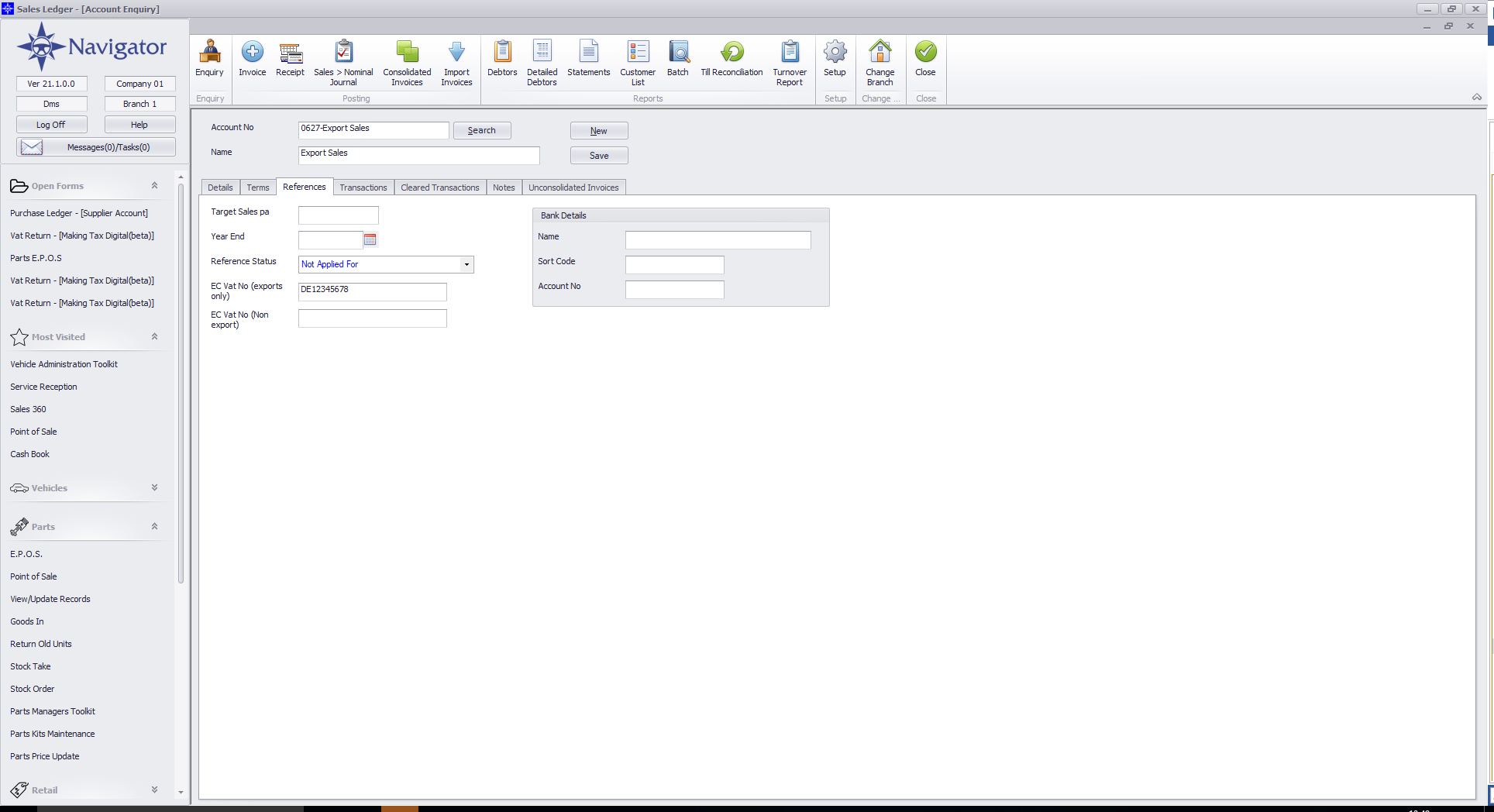

Exports to the EU

Sales to customers in the EU must be processed through a Sales Ledger Account, which has the EU VAT no entered on it on the References tab as below :-

Again, the VAT number should have the ISO Country prefix - "DE" for Germany in this case.

Any sales made to this account will be reported on the VAT 100 in Box 8 - For Supplies to other EC Member states :-

Imports from Outside the European Union

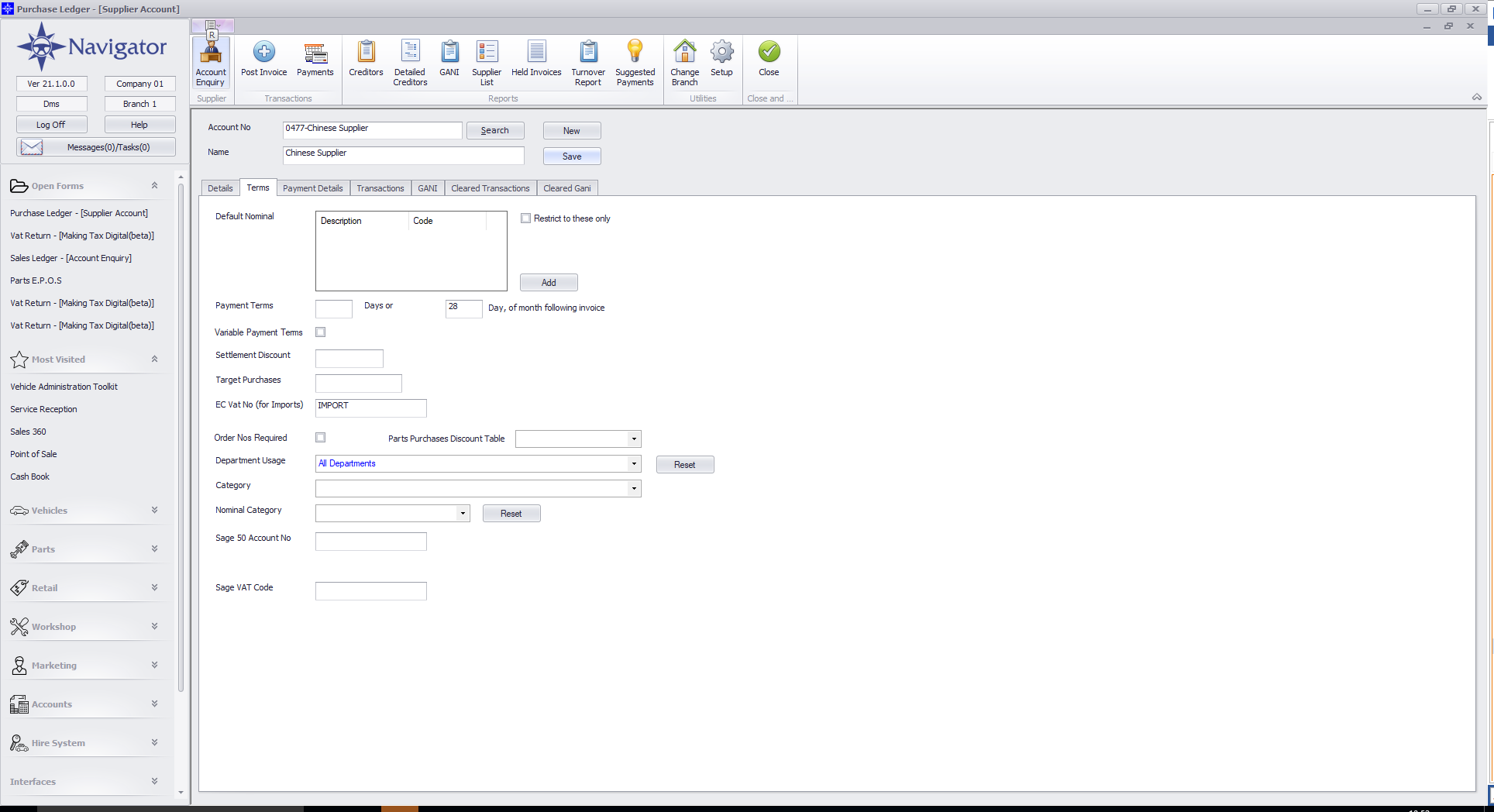

These are processed in a similar way to imports from within the EU but the VAT Number on the Supplier Account should contain the word IMPORT eg :-

Any purchase invoices posted to this account will be recorded on the Full VAT Report within the VAT return with a VAT Number reference of "IMPORT". However, the transaction will be completely excluded from the VAT 100 calculation.

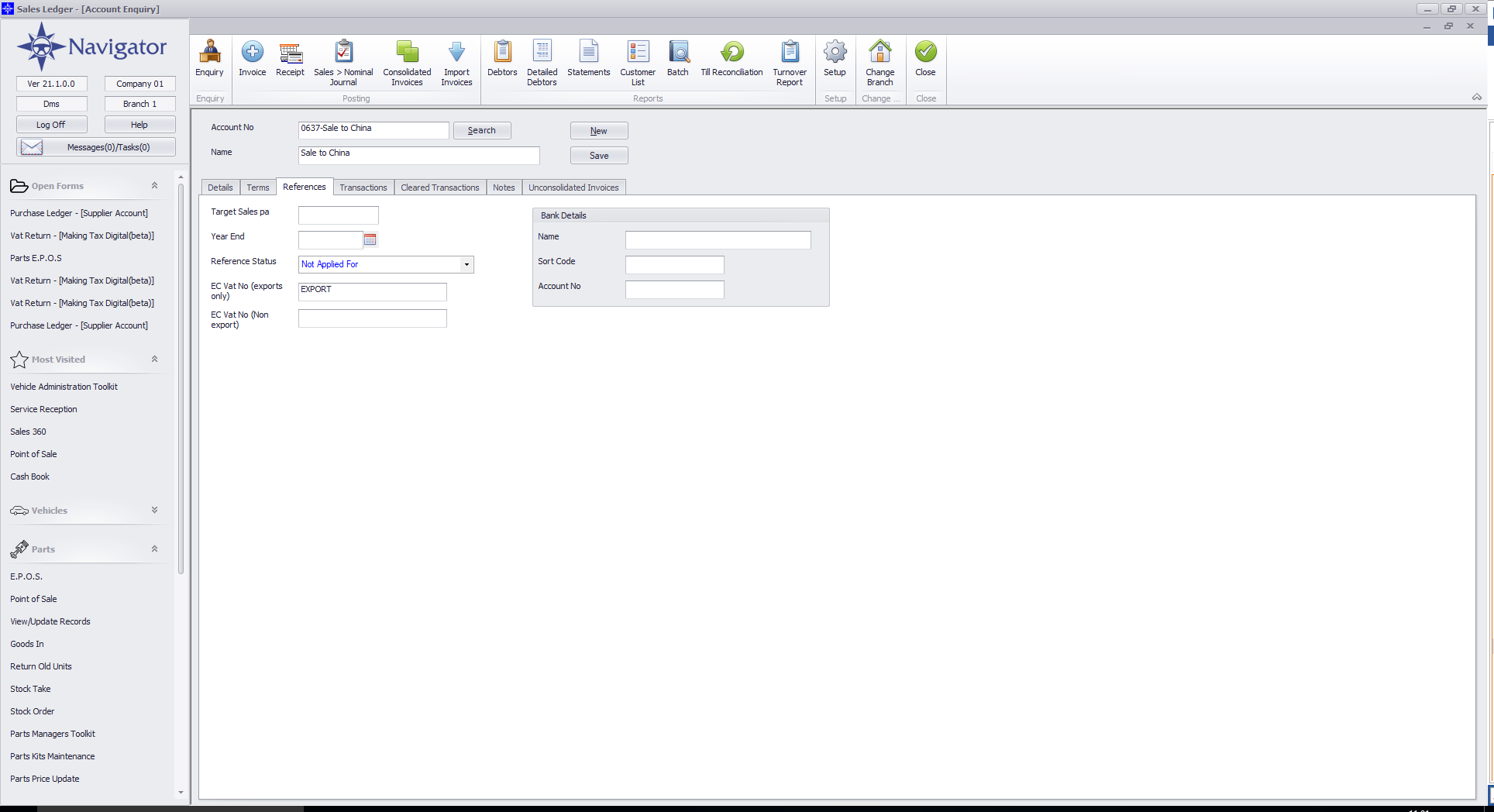

Exports to Outside of the European Union

Again, these are processed in a similar was to exports within the EU but the VAT number on the Customer Account should contain the word EXPORT eg :-