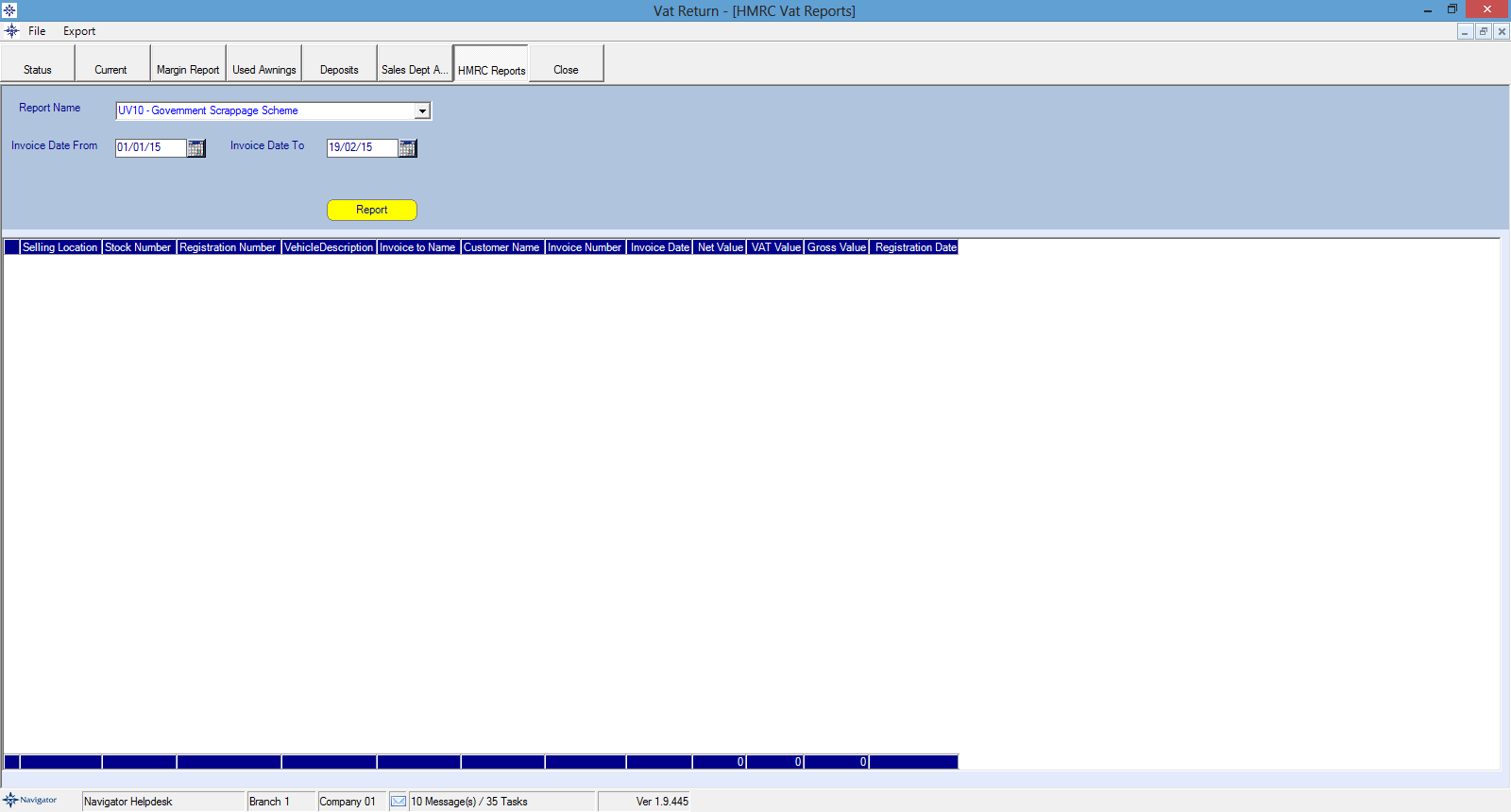

Purpose of Report:

To identify vehicles which may have been acquired as part of a deal involving the Government Scrappage Scheme, and thus to check the sale of the related new vehicle was correctly accounted for. The Government Scrappage Scheme was in operation from 18th May 2099 until February 2010.

Associated Risks:

Under the Scappage Scheme customers buying a new vehicle could "trade-in" a used vehicle which was over 10 years old and receive 2 x £1,000 subsidies against the cost of the new vehicle. The 2 x £1,000 subsidies, paid by the Government and the Manufacturer, should be treated as part-payments and not discounts. As such the VAT declared on the sale of the new vehicle bu the dealer should not be reduced by the value of these subsidies.

Bear In Mind:

•This query will only work if the trader concerned brought vehicles acquired under the Scrappage Scheme into their used vehicle stock book as "part-exchanges".

•Where the vehicle was brought into stock it should have a nil purchase value, or an equivalent purchase/sale price. The disposal of the vehicles for scrap cannot be treated as margin schemem supply and VAT will be due in full on any proceeds received from the scrap dealer.

•Having identified vehicles brought in against new vehicle sales (PARTEX numbers starting with N) you will then need to note the individual stock number of the new vehicle and check the sales invoice via the New Vehicle Stockbook ("Finance" tab) to ensure the 2 x £1,000 subsidies were correctly treated as part-payments rather than discounts.