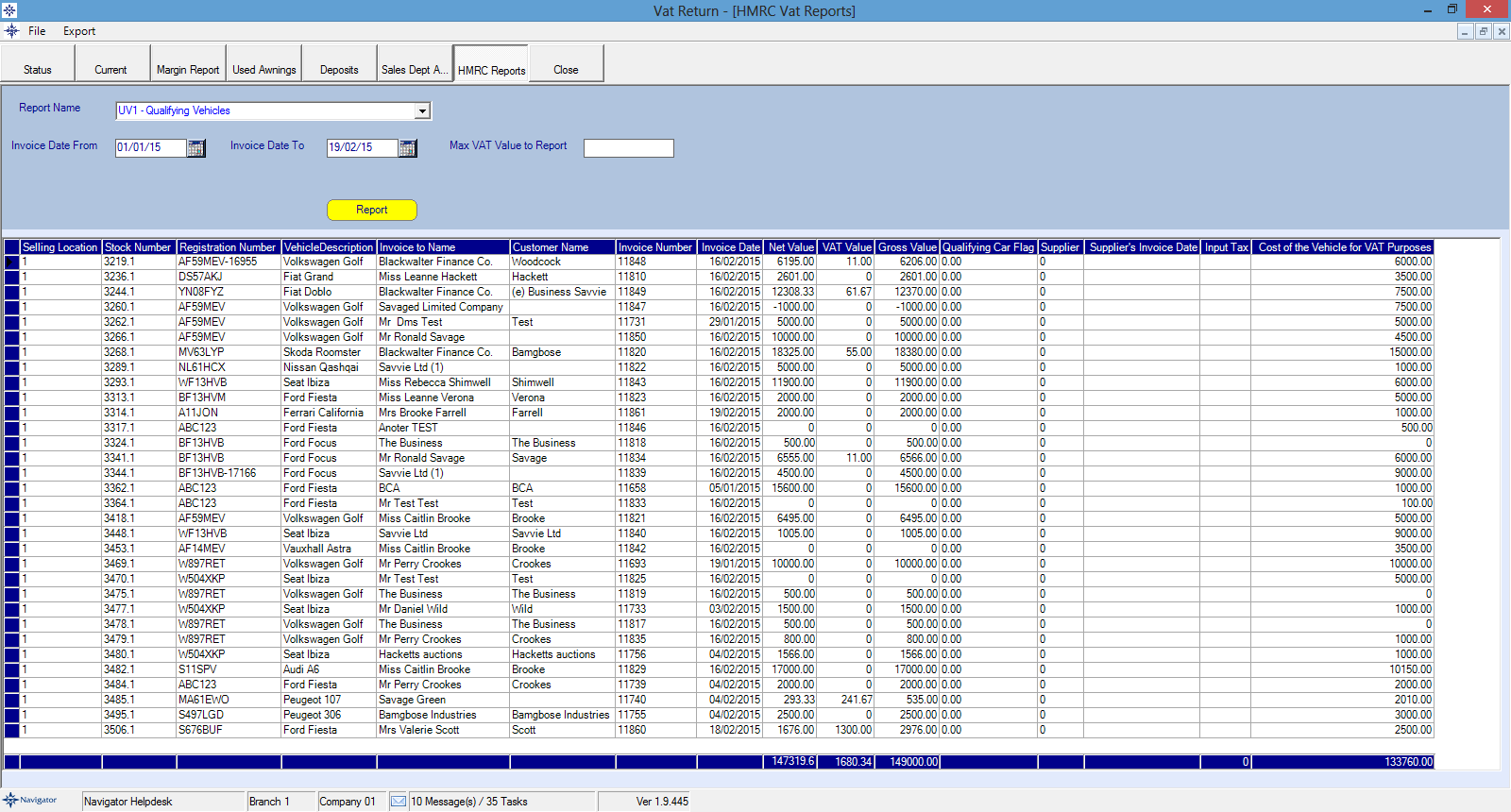

Purpose of Report:

To identify VAT-bearing used vehicles where Input VAT has been claimed on the purchase but the Output Tax declared on sale is less than this.

Associated Risks:

•Those with little or no Output VAT may have been incorrectly sold as margin scheme vehicles.

Bear In Mind:

The vehicle may have been zero-rated as a n export or disabled adaption - see bullet points under NV1 - Liability Issues. The vehicle may also have been supplied inter-company. If this is the case, ensure:

•The "importing" dealership has treated the vehicle as VAT qualifying when finally sold; and

•Input Tax hasn't been recovered again by the "importing" dealership - VAT will have already been recovered when the vehicle was originally acquired.