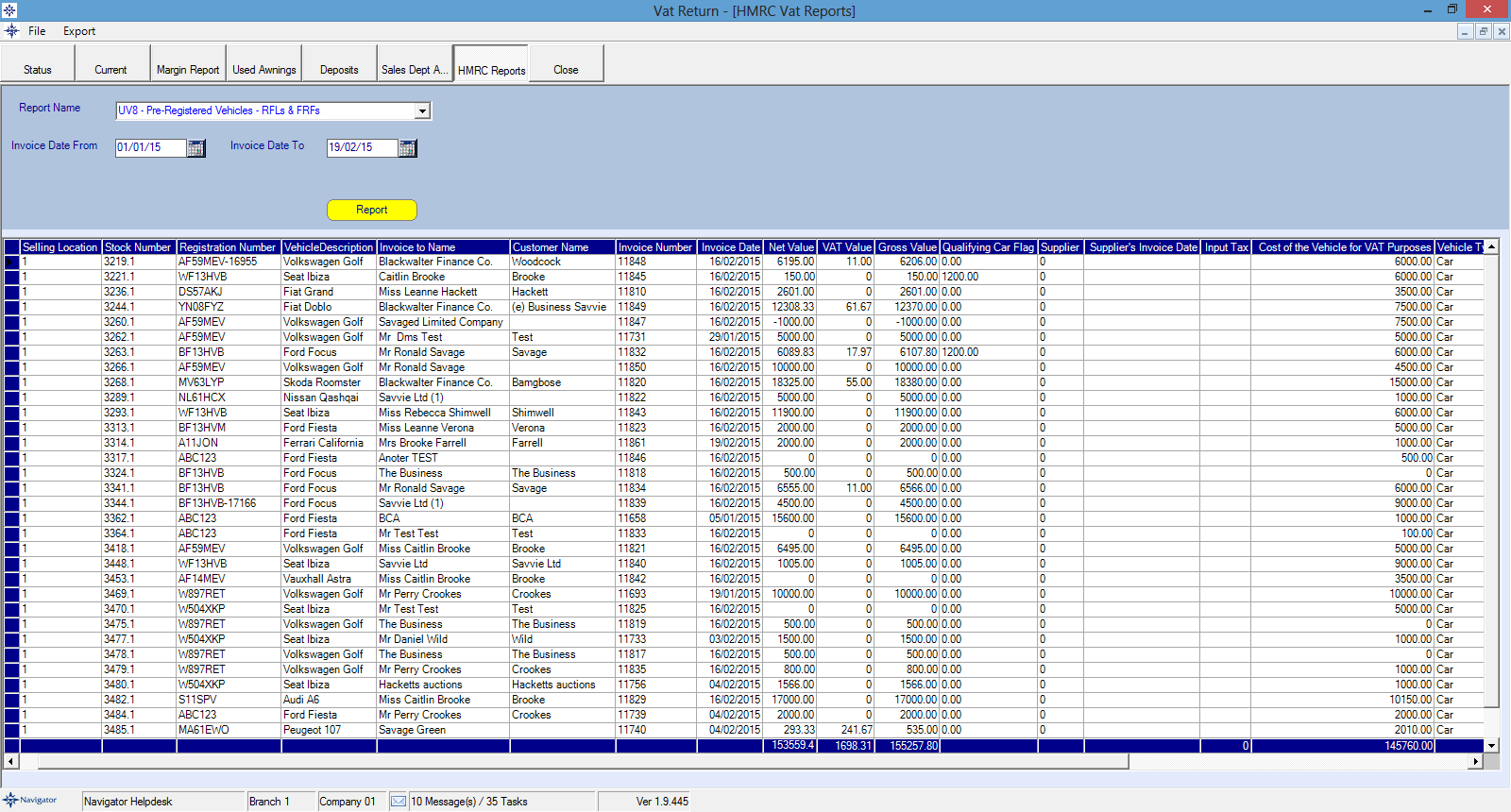

Purpose of Report:

To identify sales of pre-registered and ex-demonstrator vehicles, in order to check for incorrect treatment of Road Fund Licences (RFLs) or First Registration Fees (FRFs).

Associated Risks:

•AN RFL can only be treated as a disbursement (and outside the scope of VAT) where the dealer can demonstrate that a full, new, RFL has been purchased for the customer concerned. Where a pre-registered or ex-demonstrator vehicle is sold with the balance of an existing RFL then this is a single supply of a taxed vehicle.

•The Government First Registration Fee (FRF) cannot be recharged as a disbursement on the sale of a pre-registered or ex-demonstrator vehicle under any circumstances. This is because the vehicle will already have been registered in the dealer name when new.

Bear In Mind:

•This report should be run for a limited time period initially as it will identify all sales of pre-registered and ex-demonstrator vehicles. The sales invoice for individual transactions can then be checked for incorrect recharges of RFLs and RFRs.

•Once run the report should be exported to an Excel spreadsheet and checks concentrated on those sales with the shortest date difference between the registration date and the invoice date. You may be able to insert a formula field within Excel to calculate the difference between these dates.